Successfully qualifying for a tender

Date

December, 2025

Reading time

11 minutes

Category

Best practice

Peggy Herman

is co-founder and Managing Director of Bee4win, where she oversees the company’s consulting and pre-sales service activities. Since 2002, she has managed numerous public and private tenders, ranging from a few tens of thousands to several hundred million euros, in sectors as varied as IT, energy, industry and events. An expert in pre-sales, Peggy continues to provide bid management and writing services, coaching and training. She has also been conducting studies on best practices in this field for over 10 years. Committed to the development of the pre-sales profession, she is president of the French-speaking chapter of APMP and a frequent speaker at events including the Bid and Proposal Conference Europe and Bee4win’s customers.

Experte en avant-vente, Peggy réalise encore aujourd’hui des prestations en bid management, bid writing, coaching et formation, et mène depuis 10 ans des travaux d’étude sur les meilleures pratiques du domaine. Engagée dans la promotion de l’avant-vente, elle préside le chapter Francophonie de l’APMP et intervient régulièrement en tant que conférencière, notamment lors de la Bid and Proposal Conference Europe et auprès des clients de Bee4win.

Mots clés

#Go/No-go

#Tenders

#Qualification

Responding to a tender does not begin when we write the proposal: everything is decided well before that.

The commercial qualification is a strategic sales activity: it is at this stage that we determine whether or not an opportunity is worth investing time, resources, and energy in. However, too many teams exhaust themselves on deals that are lost before they even begin or poorly targeted, driven by the fear of “missing out on an opportunity” or the illusion that the more we respond, the more we win.

The reality is simple: the important thing is not to respond, but to win and successfully deliver what we have sold.

Qualifying means choosing. It means deciding with clarity, method, and objectivity where our sales efforts will create the most value. In this article, we offer a structured and operational framework for successfully qualifying a bid, building a winning strategy, and securing the use of our resources and the success of our projects.

1. What is sales qualification?

Qualification is a structured, documented, and collaborative process designed to assess the relevance and feasibility of a sales opportunity.

It is not limited to a simple exchange with the customer or a quick read of the specifications, but requires an in-depth analysis of the customer, the competitive environment, and the alignment of the opportunity with our company’s strategy. This is the stage where we move from a “potential opportunity” to a “deal we are able to win and deliver.”

Qualifying means understanding what is behind the apparent demand, identifying the players, assessing the competition, analyzing the risks, measuring the effort, and making a fully informed decision.

2. Why is good commercial qualification essential?

a. Making the right Go/No Go decision

Making the right Go/No Go decision means, above all, avoiding wasting our teams’ energy on deals where the chances of success are low. Qualification serves precisely this purpose: to provide a clear diagnosis, based on tangible evidence, to determine whether an opportunity is really worth investing in. By objectively analyzing the issues at stake, the competitive environment, and weak signals, it allows us to identify early on which deals are doomed to fail.

Unlike a decision made on gut feeling or excessive optimism, the Go/No Go decision must be based on a strategic, factual, and objective arbitration. When the qualification is poorly conducted, the company risks responding to tenders that are already locked, unnecessarily mobilizing its experts, diluting its commercial efforts, and ultimately undermining the quality of truly relevant responses.

Conversely, a conscious No Go decision is not a surrender, but a sign of commercial maturity. It allows resources to be concentrated where they will have an impact, improves overall pre-sales performance, and protects teams. Saying no to a bad opportunity means giving ourself a better chance of winning the good ones.

b. Define the right response strategy to win

If qualification leads to a Go, then qualification provides much more than just a green light: it helps define the roadmap toward winning the tender. The challenge is not just to participate, but to build the concrete conditions for success, in other words, to score more points than competitors on the criteria that truly matter to the customer. Qualification is precisely what enables this strategy to be developed.

The qualification phase must make it possibleto identify our strengths, differentiators, and weaknesses in order to establish a clear understanding of our positioning.

The more completely, accurately, and objectively we determine our positioning, the stronger the strategy we will subsequently develop to capitalize on our strengths and to mitigate or work around our weaknesses.

3. Methodology and process: Who does what? When?

To be effective, qualification must be formalized and integrated into the opportunity lifecycle.

|

Step |

Person(s) in charge |

Key moment |

Details / Objectives |

|

Collection of general information |

Sales |

As soon as the opportunity is identified |

Quickly understand the customer’s context and challenges. Identify the players and detect the first weak signals. |

|

Detailed qualification (grid) |

Sales & Bid Manager |

Prior to decision-making |

Analyze the need and constraints precisely. Assess the relevance of our positioning and the chances of success. |

|

Resource validation and risks |

Bid manager & Production Manager |

Prior to decision-making |

Confirm the technical and operational feasibility of the response on the one hand and the implementation of the project on the other. Identify risks and validate the availability of resources. |

|

Go/No Go Decision |

Decision-maker, Sales Representative, Bid Manager |

During the Go/No Go decision-making gate |

Collectively decide on whether to pursue the opportunity. Verify strategic alignment and the effort required to respond. |

4. Best practices and tools for properly qualifying a deal

a. All sources of information are worth exploring

Qualifying an opportunity is like conducting an investigation, and as with any investigation, don’t hesitate to use multiple sources of information to find the answers to your questions. The project’s client managers or the contents of the tender documents are obviously the first sources of information to explore. But we can find additional information about the client’s challenges and strategic projects by visiting their website, LinkedIn page, or reading press releases. Analyzing the outgoing contractor’s “Customer Success” pages can also provide us with very useful information about the project, its volume, key points, and the benefits it has brought. If we have ongoing projects for this client, we can ask your teams and their client contacts. In short, don’t settle for “we don’t have the information”; do your own research!

b. The four fundamental questions to ask yourself

1. Do I understand what is at stake?

This question allows us to check our understanding of the project environment. It involves knowing the history, constraints, the client’s real challenges, and the specific reasons for the call for tenders. A superficial or vague understanding of the key success factors is a warning sign: without it, any response strategy is fragile.

It is not enough to rephrase the expressed need; we must identify the real issue, the trigger for the project, the constraints, and the weak signals revealing tensions, past failures, or external influences. In-depth analysis is essential to building a solid strategy.

2. How important is this opportunity?

This question measures strategic alignment: Does the project correspond to our core target or does it represent a strategic gain (key reference, new skill)? What is the level of risk? Will the return on investment be satisfactory? Is there a political or reputational dimension? Should this project open the door to new opportunities? How much effort do we want to put into this response? An opportunity may seem interesting but may not justify the investment if it lacks strategic consistency, profitability, or if the level of risk is too high.

3. Can we compete?

Do we have teams available to respond with the required level of qualification and the desired level of effort within the given timeframe? Do we have the necessary means and resources to carry out the project once it has been won, in accordance with the client’s requirements?

Without sufficient resources, it is sometimes preferable not to respond, otherwise we risk exhausting our teams or reducing our chances of winning a more interesting opportunity.

4. What are our chances of winning?

This question assesses our competitive positioningand our ability to respond effectively. Do we have access to decision-makers and influencers? Are we perceived favorably compared to our competitors? If our positioning is unfavorable or if we cannot deliver on our commitments, the risk of rejection is high. This involves analyzing our legitimacy, the relevance of our differentiation, our potential competitiveness, and the position of our competitors, particularly if there is already a service provider in place. Clear-headedness is essential: being good is not enough; we have to be perceived as better on the criteria that matter to the customer. Without clear differentiation, success is unlikely.

Saying “no” is not giving up; it is a sign of commercial maturity. We have to choose the battles that create value, not those that exhaust us.

c. How to evaluate a deal objectively and methodically

To go beyond mere intuition, the most effective tool is to use an evaluation grid. This structured grid contains key questions (between 15 and 30) divided into four to six main areas, allowing each opportunity to be objectively assessed on a scale of 1 (very favorable) to 5 (unfavorable), for example:

- Customer intimacy: access to decision-makers and knowledge of commercial history.

- Alignment with corporate strategy and underlying business opportunities: correspondence with the company’s priorities and objectives.

- Ability to respond: adequacy of expertise and proposed offering.

- Ability to deliver: availability of resources and adherence to schedule.

- Competitive positioning: analysis relative to other players in the market.

- Risks and commitments: identification of constraints and obligations related to the project.

It is up to you and your team to define the recurring questions you want to ask yourself systematically each time you qualify a new opportunity, by area of analysis. You can also provide for variations depending on the type of offers you propose.

d. The value of the SWOT & Sweet Spot tools

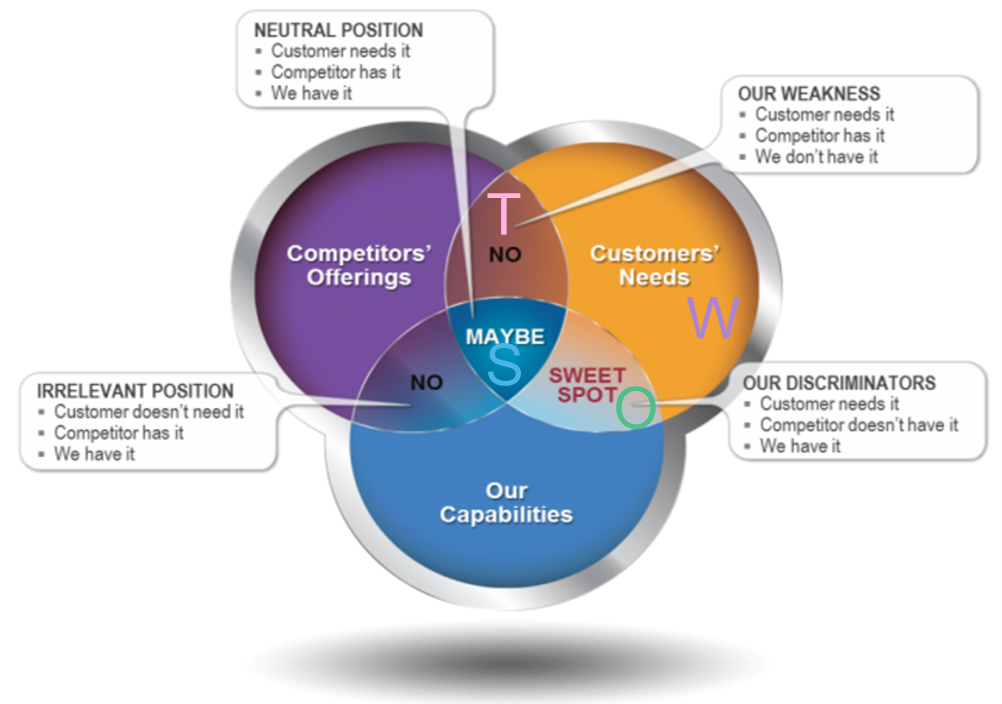

To summarize the competitive analysis, tools such as the SWOT matrix or Sweet Spot diagram are very useful:

- SWOT: allows us to formally summarize the company’s internal strengths and weaknesses as well as external opportunities and threats. Its main purpose is to justify and guide the strategy for responding to the call for tenders, by providing a clear vision of the strengths to be promoted and the weaknesses to be mitigated.

- The Sweet Spot (proposed by APMP in its body of knowledge): illustrates the optimal alignment between our strengths, the critical needs of the customer, and the weaknesses of the competition. Its role is to confirm that we are in a strategic position where we have the best chance of success, where our strengths meet exactly what the customer values and where the competition is less effective. It is a slightly different way of representing our competitive positioning than SWOT, but the purpose is similar.

To take things even further, we can also enhance our qualification grid so that we can automatically and objectively fill in your SWOT matrix or Sweet Spot diagram based on the answers to the various questions, or present the weighted answers for each axis on a radar chart. Feel free to contact the Bee4win Consulting and Services team for assistance in setting up this type of tool.

To discover other useful tools for effectively qualifying an opportunity and defining your response strategy, we invite you to read our article: The pre-sales strategist’s toolbox: 8 essential tools for winning more business!

Conclusion

Qualification is often rushed, even though it is crucial for making the right decisions. It helps us keep a clear head and focus our efforts where they really add value: on opportunities that are truly winnable and profitable. By relying on an objective method (qualification grid) and clear synthesis tools (SWOT, SWEET SPOT), we can set aside illusions and put all our energy into the opportunities where we have the highest chances of success.

Blog articles

How do you organize your response to a call for tenders ?

The Pre-Sales Strategy Toolbox: 8 Essential Tools to Win More Bids

The presales process: A road trip to winning bids

Copyright © 2025 Bee4win